Obsolescence and Long Life Support

OEM's of Agriculture, Construction, and Commercial Vehicles have long life expectancies for their finished vehicles, in some cases 30+ years. Unfortunately, the sophisticated electronic components, such as the microprocessors, only have new production runs which are typically only 5-7 years. Traditionally, this has left these OE's with the difficult and expensive options of either purchasing significant end-of-life inventories or redesigning the electronic controls to accommodate newer components. Remanufacturing is a solution to these obsolescence challenges, which is elegant, environmentally friendly, and profitable.

While Obsolescence and Long Life Support is our critical value proposition, we have effectively and profitably utilized reman concepts throughout the life-cycle of a given electronic product family. From cradle to grave, reman can add critical value to business requirements such as Warranty Support, Repair Services, Legacy Manufacturing and Core Management.

Scroll over the product life-cycle chart to learn more about our various services and their potential impacts:

TIME

Introduction

This is where all new products begin. Most of the products we target, such as ECMs and Displays, come standard on our OE Partner's finsihed whole goods (i.e. Tractor, Combine, etc) in addition to service part offerings to handle upgrades and warranty support. During this phase we have found significant advantages to kicking off our Warranty Administration activities over these new components. As we are constantly thinking on how to improve our Partners Quality, Costs and (where applicable) Designs, our access to facilitate and administer warranty through our team of reman experts simply makes sense. As we move out of the initial warranty phases of new components we are also well equiped with field failure mode data as we begin to consider Reman offerings.

Growth/Stability

As programs depart their first 12-18 months of new production, this is the timeframe where development of a reman program typically begins. At this point there is typically available data to target any specific failure modes as well as where we begin looking at the various processes required for reman, such as dissassembly, component repairs, testing, etc. There are several considerations for launching at this time. Primarily, this enables the OEM to get in front of any significant latent field defects where a reman offering can significantly lower OE exposure on the related costs. In addition to this primary consideration, down stream product enhancements can sometimes be achieved through the reman process. Finally, this process is a good starting point for the collection of cores, which will ultimately be used to fuel long life product support requirements.

Maturity

At this stage the marketplace is relatively saturated with new product. Additionally, the OE typically stops investing in additional capacity as these new volumes peak. With a reman offering, our OE Partners have the primary value add of Availability to their end-users, ensuring achievement of critical KPI's such as fill-rate and end-user up-time.

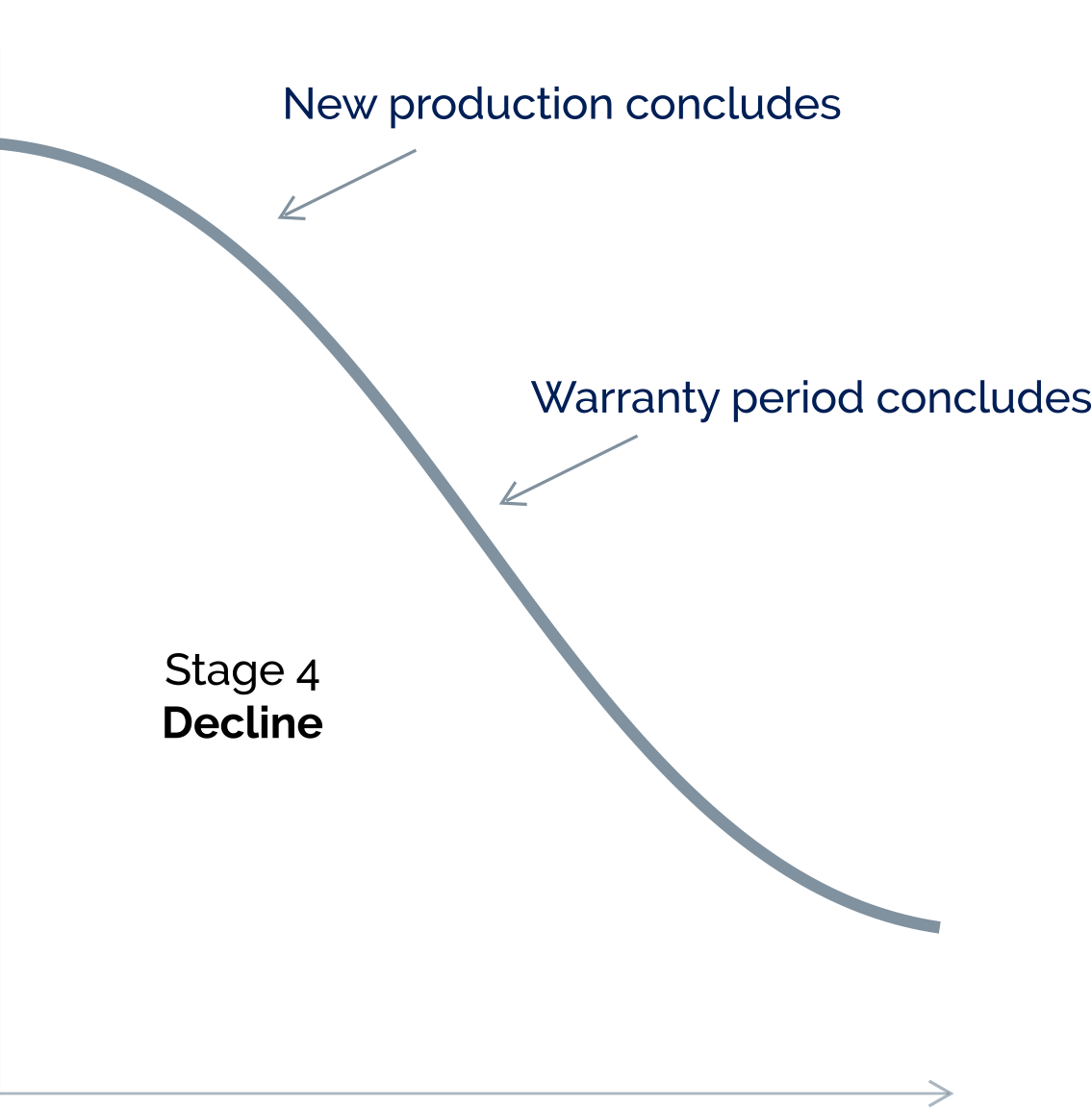

Decline

The declining phases of new electronic products is where a reman option has a significant impact on our OE Partners overall busienss. Specifically, we have the ability to support the long life requirements of the end user, thereby eliminating the need for significant lifetime purchases by the OE. Our primary value proposition is keeping our OE's end users up and running in spite of new component obsolescence. In this phase we have also had success taking over Legacy Manufacturing activities from new production as those opportunities transition out of production altogether. The key value here is that new production can repurpose this legacy capacity to go after additional new product offerings. Lastly, we also look to support our OEM's through additional end-user service offerings such as directly distributed repair services.